Economic Developments - May 2025

Key Takeaways

- We have revised our real gross domestic product (GDP) growth outlook for 2025 and 2026 to 0.7 percent and 2.0 percent on a Q4/Q4 basis, up from 0.5 percent and 1.9 percent in our prior forecast, respectively.

- We now expect the Consumer Price Index (CPI) to rise 3.5 percent Q4/Q4 in 2025, unchanged from our April forecast. Core CPI is expected to rise 3.8 percent Q4/Q4 in 2025 (down from 3.9 percent previously) and 2.6 percent in 2026 (unchanged).

- We forecast mortgage rates to end 2025 and 2026 at 6.1 percent and 5.8 percent, respectively, down from 6.2 percent and 6.0 percent in our prior forecast.

- Our home sales outlook for 2025 was revised to 4.92 million, up from 4.86 million previously.

- We project mortgage originations to rise to $1.99 trillion and $2.38 trillion, respectively, for 2025 and 2026, compared to our previous forecast of $1.98 trillion and $2.33 trillion, respectively.

Housing & Mortgage Forecast Table

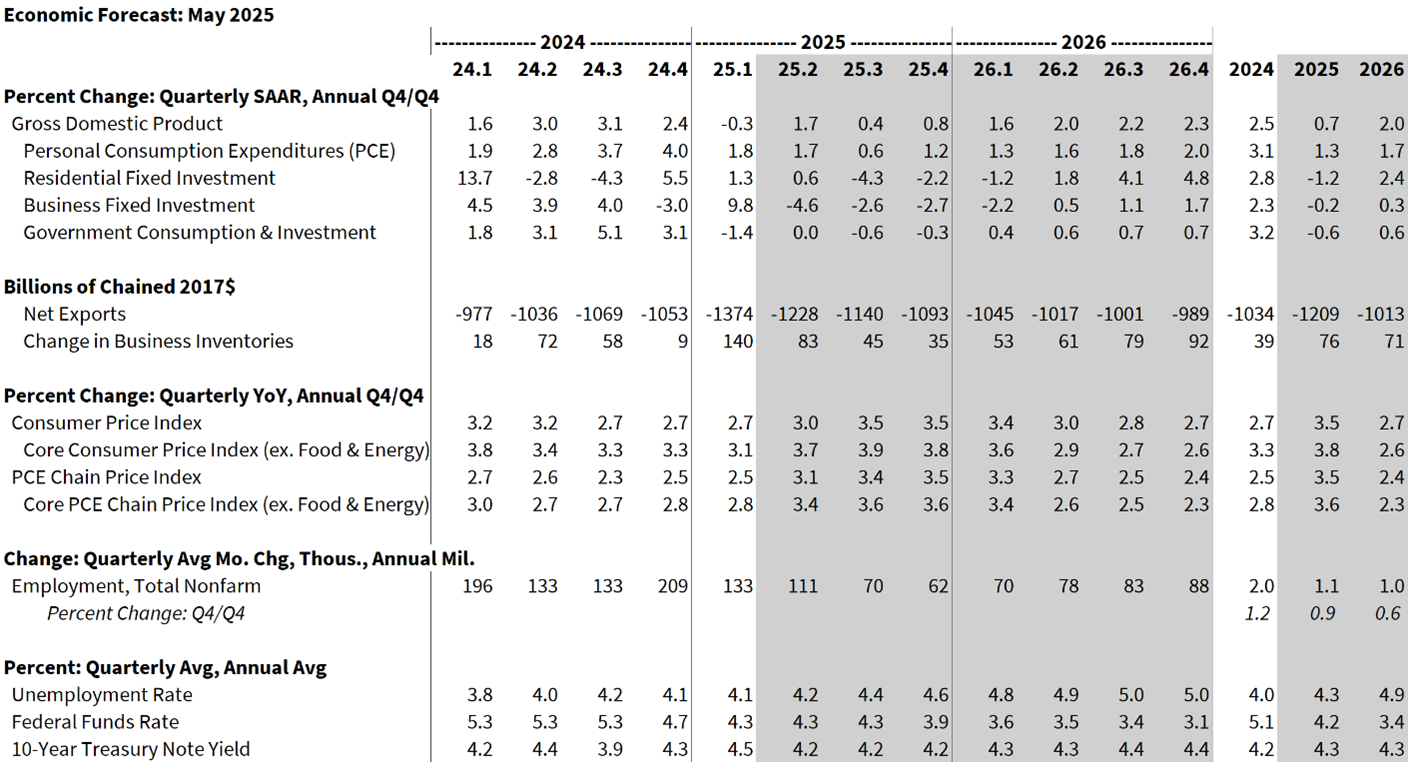

Economic Forecast Table

Forecast values as of May 12, 2025

Note: Interest rate forecasts are based on rates from April 30, 2025; all other forecasts are based on the date above.

Note: Unshaded areas denote actuals. Shaded areas denote forecasts.

Sources: Actuals: Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Board. Forecasts: Fannie Mae Economic and Strategic Research

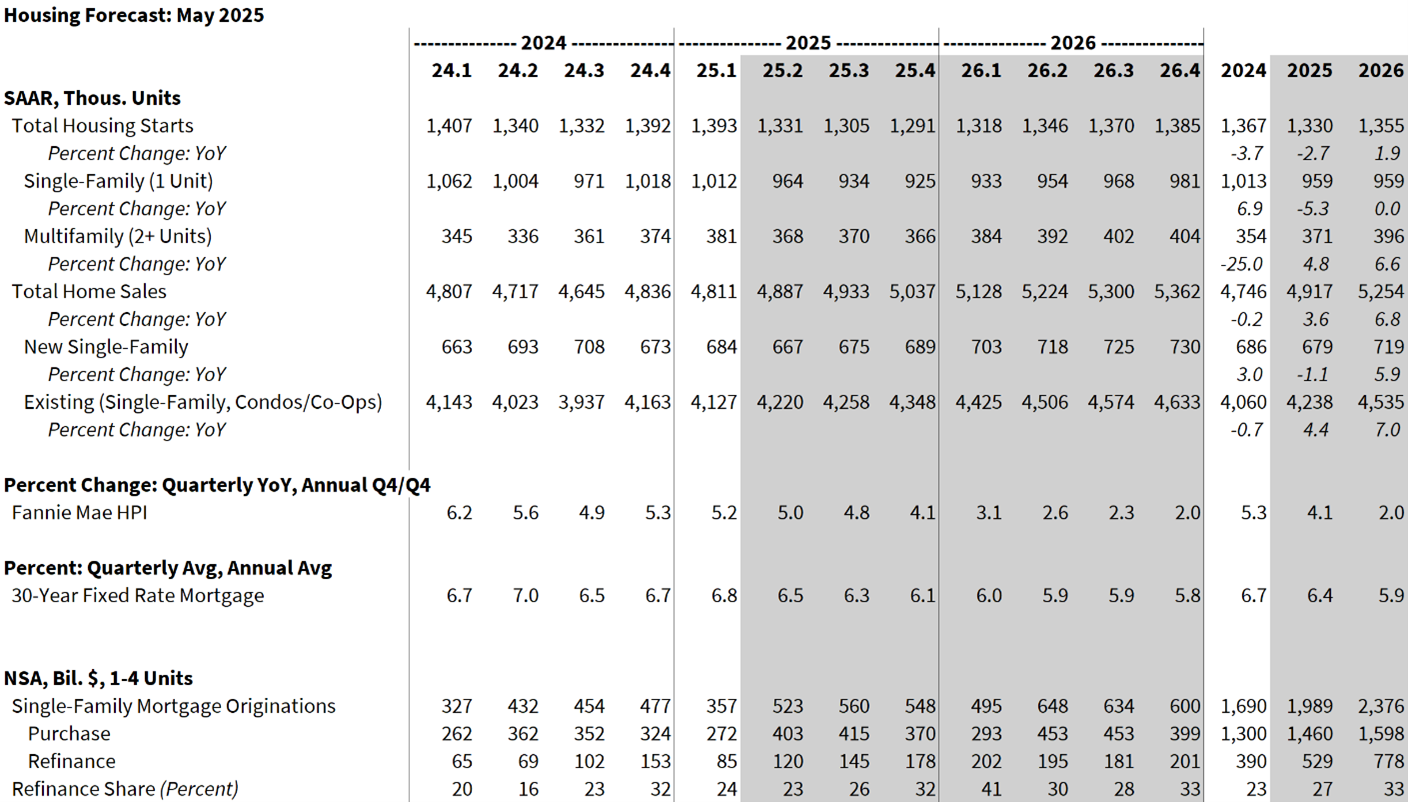

Housing Forecast Table

Forecast values as of May 12, 2025

Note: The Fannie Mae HPI forecast is updated on the first month of every quarter. Interest rate forecasts are based on rates from April 30, 2025; all other forecasts are based on the date above.

Note: All mortgage originations data are Fannie Mae estimates as there is no universal source for market-wide originations data.

Note: Unshaded areas denote actuals. Shaded areas denote forecasts.

Sources: Actuals: Census Bureau, National Association of REALTORS®, Freddie Mac - Forecasts: Fannie Mae Economic and Strategic Research

Economic & Strategic Research (ESR) Group

Mark Palim, SVP and Chief Economist

May 15, 2025

Opinions, analyses, estimates, forecasts, beliefs, and other views of Fannie Mae's Economic and Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, beliefs, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The opinions, analyses, estimates, forecasts, beliefs, and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.